As a result, the broad benchmark index slumped nearly 4%, entering bear market territory, meaning it is now down more than 20% from its most recent high.

After briefly entering a bear market last month, the S&P 500 was able to pull back.

In addition to the Dow Jones, other indexes both declined, with the Nasdaq down nearly 4.7% and the Dow down 2.8%.

An inflation report on Friday showed higher inflation than expected, raising concerns the Federal Reserve may have to raise rates even more aggressively this year.

On Tuesday, the Federal Reserve will begin its two-day meeting, and one half percentage point interest rate hike is expected for the second consecutive month.

Inflation rose at its fastest rate in over 40 years in the latest inflation report, raising the likelihood of even greater rate hikes this week and in the months ahead.

The US consumer sentiment index from the University of Michigan goes back to 1952.#SP500 #NASDAQ #inflation pic.twitter.com/z8LahpnMW7

— Logan Capital (@logan_capital) June 10, 2022

The central bank’s actions may curb price gains, but markets fear a recession will also follow.

Sam Stovall, the chief investment strategist at CFRA, says the markets reacted negatively to last week’s hotter-than-expected inflation reading.

Investors are growing increasingly concerned that the Fed is too late in addressing price increases without causing an economic recession, Stovall says.

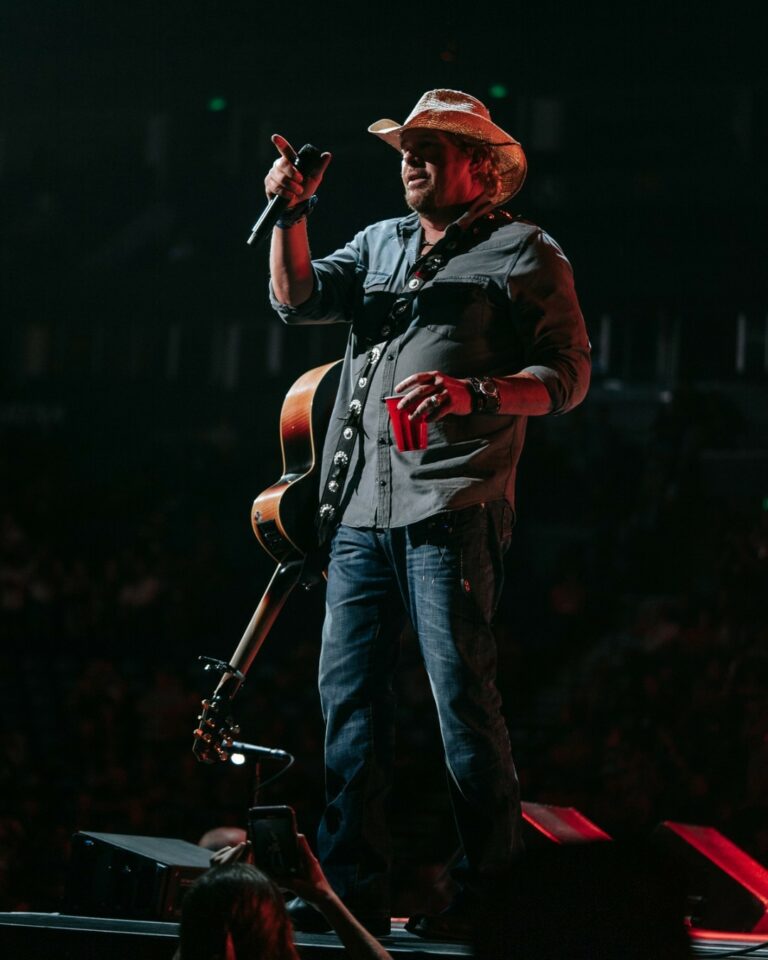

Markets Have Been in a Grim Mood for Weeks

Stocks have been hit hard by inflation fears. Technology shares dominate the Nasdaq index, which is in a bear market.

Investor pessimism is captured in a bear market, which is a deep and sustained market selloff.

The S&P 500 entering a bear market sends a powerful message to the economy.

Indexes track 500 stocks mostly from the largest U.S. companies. A leading indicator of the U.S. economy, it is a barometer of the health of corporate America.

Index funds, which represent the stocks in the S&P 500, are invested millions of dollars, including from retirement portfolios.

One of the most significant reasons why retirees worry when the value of the index decreases is that it leaves less for retirement income.

When Crypto Currencies Drop, CEOs Freak Out

It’s not just stocks that are falling. Bond markets are also slumping due to inflation fears, while cryptocurrency prices are down sharply. Bitcoin is down 50% from the beginning of the year.

Consequently, investors are only left with a few options.

Wall Street’s outlook has been clouded by more than inflation.

Globally, commodity prices have risen due to the ongoing conflict in Ukraine, and energy prices have also risen.

The national average price for a gallon of regular gasoline has now surpassed $5.00, according to AAA.

Increasing numbers of U.S. executives have given warnings about the economy.

JPMorgan Chase CEO Jamie Dimon said an economic “hurricane” is coming, and Elon Musk, Tesla’s CEO, said the carmaker would cut 10% of its salaried staff.

Musk recently wrote in an email to staff that he felt “super bad” about the economy.